37+ Paycheck Calculator West Virginia

Its average effective property tax rate of 057 is the ninth-lowest state rate in the US as comes in at about half of the national average. Subtract any post-tax deductions.

2295 Old Seneca Tpke Marcellus Ny 13108 Realtor Com

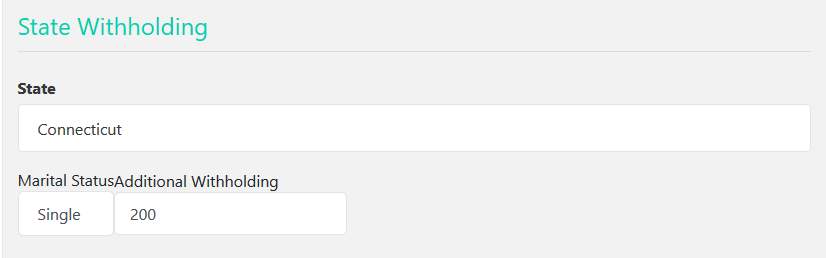

Again the percentage chosen is based on the paycheck amount and your W4 answers.

. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. Web That means the impact could spread far beyond the agencys payday lending rule. Real median household income adjusted for inflation in 2021 was 70784.

Web The percentage method is used if your bonus comes in a separate check from your regular paycheck. This tool has been available since 2006 and is visited by over 12000 unique visitors daily and has been utilized for numerous purposes. 4144 The SAN JOSE-SAN FRANCISCO-OAKLAND CA General Schedule locality region applies to government employees who work in San Francisco and.

Web Use PaycheckCitys dual scenario salary paycheck calculator to compare two salary paycheck scenarios and see the difference in taxes and net pay. Web Deduct federal income taxes which can range from 0 to 37. How is an employees Social Security and Medicare taxes calculated.

Web Gross pay amount is earnings before taxes and deductions are withheld by the employer. Must contain at least 4 different symbols. Some employees may be responsible for court-ordered wage garnishments or child support.

Supplemental wages are still taxed Social Security Medicare and. West Virginia Paycheck Calculator. No personal information is collected.

Web For a detailed calculation of your pay as a GS employee in California see our General Schedule Pay Calculator. Married Filing Jointly or Widower 0 20550. Section 1033b3 Information required to be kept confidential by other law.

Web Below are your federal gross-up paycheck results. Web The TurboTax community is the source for answers to all your questions on a range of taxes and other financial topics. Web Microsoft pleaded for its deal on the day of the Phase 2 decision last month but now the gloves are well and truly off.

The gross pay in the hourly calculator is calculated by multiplying the hours times the rate. Each Locality Area has a Locality Pay. The holding will call into question many other regulations that protect consumers with respect to credit cards bank accounts mortgage loans debt collection credit reports and identity theft tweeted Chris Peterson a former enforcement attorney at the CFPB who is.

Web SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. ASCII characters only characters found on a standard US keyboard. Web California LULAC believes climate change is a serious issue but Prop 30 is designed to help Lyft not to address our climate crisis.

Again the percentage chosen is based on the paycheck amount and your W4 answers. Be informed and get ahead with. Web There are a total of 53 General Schedule Locality Areas which were established by the GSAs Office of Personnel Management to allow the General Schedule Payscale and the LEO Payscale which also uses these localities to be adjusted for the varying cost-of-living across different parts of the United States.

The results are broken up into three sections. We join Governor Newsom and a diverse coalition in strong opposition to Prop 30. SAN JOSE-SAN FRANCISCO-OAKLAND CA Print Locality Adjustment.

Web Microsoft has responded to a list of concerns regarding its ongoing 68bn attempt to buy Activision Blizzard as raised by the UKs Competition and Markets Authority CMA and come up with an. Web Opportunity Zones are economically distressed communities defined by individual census tract nominated by Americas governors and certified by the US. This percentage method is also used for other supplemental income such as severance pay commissions overtime etc.

Military news updates including military gear and equipment breaking news international news and more. Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare. 6 to 30 characters long.

Secretary of the Treasury via his delegation of that authority to the Internal Revenue Service. Web Federal Paycheck Calculator Calculate your take home pay after federal state local taxes. Web The current tax rates are 0 10 12 22 24 32 35 or 37.

Amid rising prices and economic uncertaintyas well as deep partisan divisions over social and political issuesCalifornians are processing a great deal of information to help them choose state constitutional. Your household income location filing status and number of personal exemptions. Web Private industry union benefit costs average 2124 per hour worked in September 2022 Employer costs for private industry union workers averaged 3195 per hour worked for wages and salaries and 2124 for benefits in September 2022.

Federal income tax rates range from 10 up to a top marginal rate of 37. Web Get the latest headlines on Wall Street and international economies money news personal finance the stock market indexes including Dow Jones NASDAQ and more. California voters have now received their mail ballots and the November 8 general election has entered its final stage.

They may also choose to make post-tax contributions to savings accounts elective benefits. Withholding information can be found through the IRS Publication 15-T. Web Key Findings.

Web 2. Section 1033b4 Information that cannot be retrieved in the ordinary course of. Microsoft describes the CMAs concerns as misplaced and says that.

Web Our paycheck calculator is a free on-line service and is available to everyone. You can add multiple rates. This calculator will take a gross pay and calculate the net pay which is the employees take-home pay.

Web Our income tax calculator calculates your federal state and local taxes based on several key inputs. Your employer withholds a flat 22 or 37 if over 1 million. Web West Virginia has some of the lowest property tax rates in the country.

The current tax rates are 0 10 12 22 24 32 35 or 37. Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is your take-home pay and Calculation Based On is the information entered into the calculator.

.jpg?width=850&mode=pad&bgcolor=333333&quality=80)

Barrington North Apartments 104 112 Wedgewood Drive Morgantown Wv Rentcafe

Busorgs Chasalow Outline Flowcharts Pdf Law Of Agency Partnership

Hurricane Preparation And Safety Tips

Free Payroll Tax Paycheck Calculator Youtube

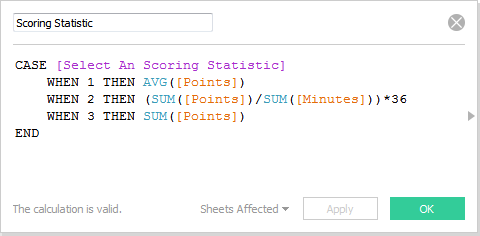

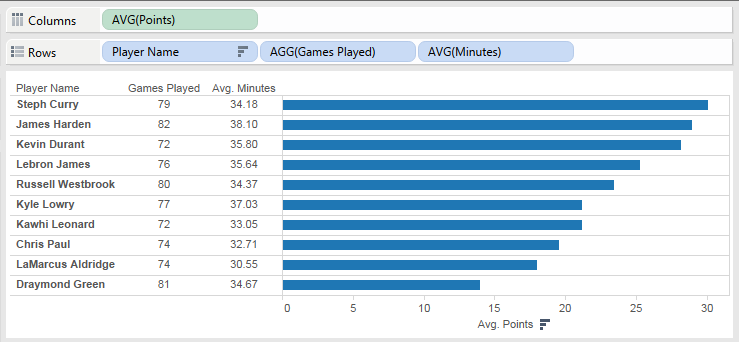

Tableau Deep Dive Parameters Calculated Fields Interworks

Villas For Sale In Bande Mutt Kengeri Satellite Town Bangalore 37 Independent Villas In Bande Mutt Kengeri Satellite Town Bangalore

Calameo 2021 06 Ca

Free Paycheck Calculator Hourly Salary Usa Dremployee

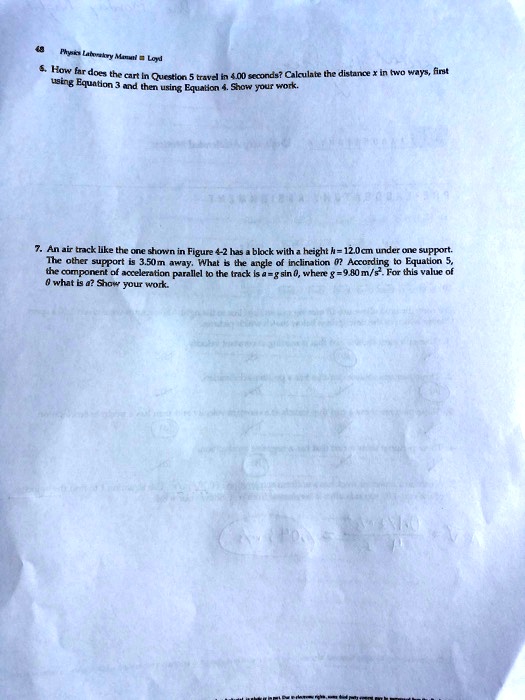

Browse Questions For Physics 101 Mechanics

West Virginia Hourly Payroll Calculator Wv Hourly Payroll Calculator Free West Virginia Paycheck Calculators

Average Salary In West Virginia 2022 The Complete Guide

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Tableau Deep Dive Parameters Calculated Fields Interworks

![]()

Free West Virginia Payroll Calculator 2022 Wv Tax Rates Onpay

.jpg?crop=%280%2C0%2C300%2C163%29&cropxunits=300&cropyunits=163&width=350&mode=pad&bgcolor=333333&quality=80)

University Square Apartment Community 2615 S University Dr Fargo Nd Rentcafe

Property For Sale In Koramangala Bangalore 37 Houses For Sale In Koramangala Bangalore

Virginia Salary Calculator 2023 Icalculator