2 compound interest calculator

Compounding interest requires more than one period so lets go back to the example of Derek borrowing 100 from the bank for two years at a 10 interest rate. You can find many of these calculators online.

How To Calculate Interest Compounding For Exponential Growth Accounting Principles Money Quotes Business Savvy

The basic calculator consists of 2 sections.

. This savings calculator includes. To calculate compound interest you first need to know. Compound It Compound Frequency Annually Semiannually Quarterly Monthly Daily.

In maths compound interest is calculated based on the principal amount and the interest accumulated over the past periods. Choose what you would like to calculate. R.

Compound Interest Formula Steps to Calculate Compound Interest. To use the compound interest calculator youll need to enter some details about your deposit. To use our calculator simply.

See how much you can save in 5 10 15 25 etc. The little 1n is a Fractional Exponent first calculate 1n then use that as the exponent on your calculator. Your principal investment amount 2.

Treasury savings bonds pay out interest each year based on their interest rate and current value. The interest can be compounded annually semiannually quarterly monthly or daily. It is the basis of everything from a personal savings plan to the long term growth of the stock market.

Basic Calculator Advanced Calculator and Cumulative Interest Payment Schedule. On this page you can calculate compound interest with daily weekly monthly quarterly half-yearly and yearly compounding. Plus you can also program a daily compound interest calculator Excel formula for offline use.

Compound interest on the other hand occurs when your interest earned then earns additional interest. Finally the total amount and the compound interest will be displayed in the output field. Range of interest rates above and below the rate set above that you desire to see results for.

Interest paid in year 1 would be 60 1000 multiplied by 6 60. Our calculator provides a simple solution to address that difficulty. Assume that you own a 1000 6 savings bond issued by the US Treasury.

The calculation of compound interest can involve complicated formulas. Review the Table View. R is the nominal annual.

However those who want a deeper understanding of how the calculations work can refer to the formulas below. A n is the amount after n years future value. A 0 is the initial amount present value.

Therefore the fundamental characteristic of compound interest is that interest itself. Now click the button Solve to get the compound interest. The MoneyGeek compound interest calculator uses a pie chart to show you the initial amount you contributed in purple the total interest you earned in green and your total contributions in blue.

It is the result of reinvesting interest or adding it to the loaned capital rather than paying it out or requiring payment from borrower so that interest in the next period is then earned on the principal sum plus previously accumulated interest. In addition you can include negative interest rates and inflation increases as part of your calculation. Based on Principal Amount of 1000 at an interest rate of 75 over 10 years.

For example 2 02 is entered as 2 xy 0 2 Now we can plug in the values to get the result. Those cells having light-blue color is the input section and cells with dark blue are the. If youre unsure how frequently the interest on your investment is compounded you may wish to check with your bank or.

Monthly compound interest is the most common method used by financial institutions. The number of times your interest gets compounded per year 4. A t A 0 1 r n.

Generally compound interest is defined as interest that is earned not solely on the initial amount invested but also on any further interestIn other words compound interest is the interest on both the initial principal and the interest which has been accumulated on this principle so far. Compound interest is the addition of interest to the principal sum of a loan or deposit or in other words interest on principal plus interest. Years at a given interest.

However simple interest is very seldom used in the real world. If you start with 25000 in a savings account earning a 7 interest rate compounded monthly and make 500 deposits on a monthly basis after 15 years your savings account will have grown to 230629-- of which 115000 is the total of your beginning balance plus deposits and 115629 is the total interest earnings. Just click the compound interest table on the right and youll see each year your starting balance your annual.

How to Use the Compound Interest Calculator. Using this compound interest calculator Try your calculations both with and without a monthly contribution say 50 to 200 depending on what you can afford. The amount after n years A n is equal to the initial amount A 0 times one plus the annual interest rate r divided by the number of compounding periods in a year m raised to the power of m times n.

Calculate interest compounding annually for year one. Our calculator allows the accurate calculation of simple or compound interest accumulated over a period of time. The basic formula for compound interest is as follows.

The rate of interest your investor offers 3. This will be the base amount the compound interest is calculated on. Say you have an investment account that increased from 30000 to 33000 over 30 months.

These are explained below. Select the currency from the drop-down list this step is optional. Compound interest is a method of earning interest on your invested money.

Even when people use the everyday word interest they are usually referring to interest that compounds. Using this monthly compound interest calculator you can accurately determine the result of compound interest on your investments when compounded monthly. Our compound interest calculator includes options for.

Think of this as twelve different compound interest calculations one for each quarter that you deposit 135. That amount is compounded quarterly for the number of quarters remaining before the end of the three-year period. Include additions contributions to the initial deposit or investment for a more detailed calculation.

Total Value 206103 Total Interest 106103. Compound interest - meaning that the interest you earn each year is added to your principal so that the balance doesnt merely grow it grows at an increasing rate - is one of the most useful concepts in finance. If your local bank offers a savings account with daily compounding 365 times per year what annual interest rate do you need to get to match the rate of return in your investment account.

The Principle of Compound Interest. At the end of three years simply add up each compound interest calculation to get your total future value. Use of a continuous compound interest calculator is among the various benefits of this strategy is the fact that it allows you to visualize investment horizons.

Initial Deposit This is the starting amount of money you plan to deposit into savings. Estimate the total future value of an initial investment or principal of a bank deposit and a compound interest rate. Daily monthly quarterly half-yearly and yearly compounding.

This template consists of 3 sheets. Our online tools will provide quick answers to your calculation and conversion needs. With Compound Interest you work out the interest for the first period add it to the total and then calculate the.

Contents of Compound Interest Calculator Excel Template. What is Meant by Compound Interest. You can also use this calculator to solve for compounded rate of return time period and principal.

Compound Interest Formulas Calculator Interest Calculator Compound Interest Compound Interest Math

Calculate Compound Interest In Excel Personal Finance Lessons Excel Calculator

Excel Savings Interest Calculator Personal Tools Simple Compound Interest Savings Tracker Spreadsheet

Much Money You Will Find In Your Bank Account At The End Of 3 Years Simply Copy The Same Formula Compound Interest Excel Formula Interest Calculator

Compounding Interest Rate Chart Interest Rate Chart Financial Charts Chart

How To Calculate Compound Interest 15 Steps With Pictures Compound Interest Interest Calculator Simple Interest

Excel Formula Calculate Compound Interest Excel Excel Formula Loan Amount

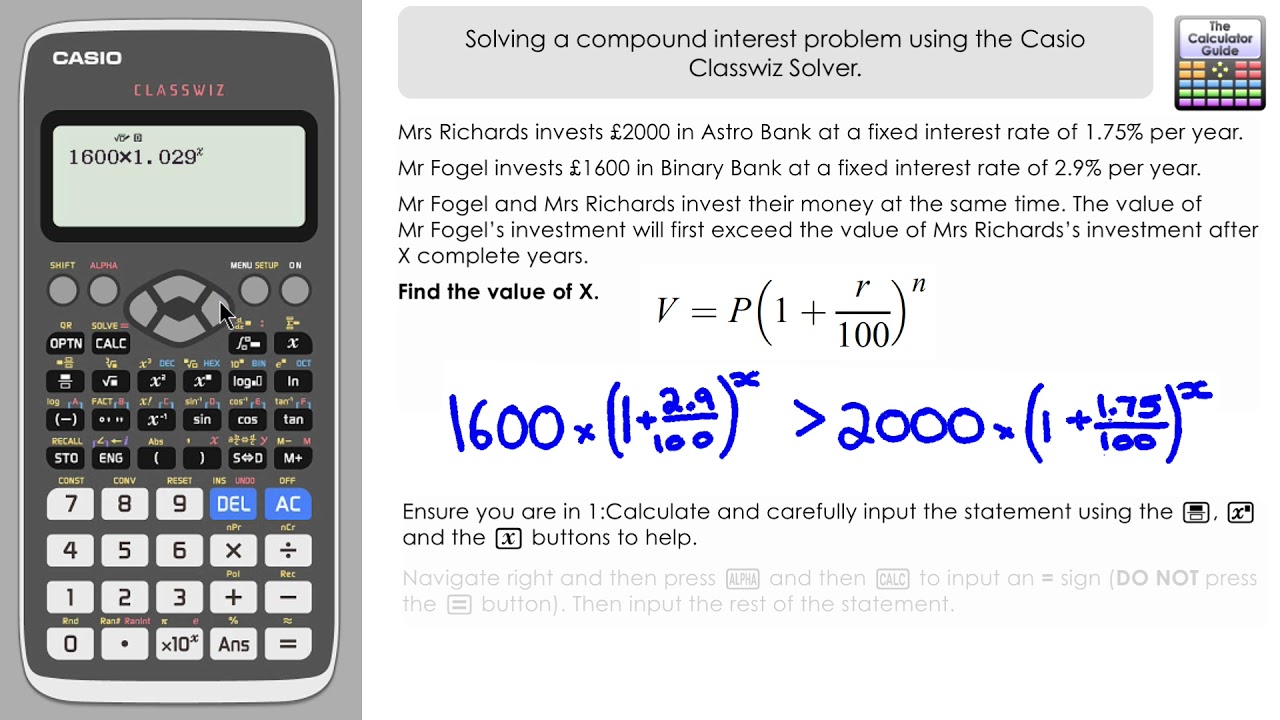

Compound Interest Problem Solving On Casio Classwiz Calculator Fx 991ex Calculator Problem Solving Solving

Download A Compound Interest Calculator For Excel Or Use The Online Calculator For Compound I Interest Calculator Compound Interest Investing Compound Interest

Compound Interest Calculator Or Formula For Money Square Footage Calculator Interest Calculator Square Foot Calculator

Using Logs Compound Interest Compound Interest Graphing Calculator Compounds

Compound Interest Formula And Compound Interest Financial Quotes Formula

3 Ways To Calculate Daily Interest Wikihow Calculator Interest Calculator Microsoft Excel

How Do Investments Add Up Over Time Check Out This Compound Interest Calculator Interest Calculator Investing Compound Interest

Formula For How To Calculate Compound Interest Interest Calculator Compound Interest Math Formulas

Data Table In Excel How To Create One Variable And Two Variable Tables In 2022 Data Table Excel Data

Compound Interest Calculating Tool Compound Interest Interest Calculator Compounds